One of the first topics our tax agent covered a few years back was unemployment tax. Larry said, “Single-employee S-corporations must pay unemployment insurance, but you can never claim unemployment from your own dissolved company. I don’t believe this is fair, but there’s nothing we can do about it.” So we pay unemployment taxes.

As usual, NPR delivered several gloomy economic reports this week as the U.S. Unemployment Rate rose again to 9.8%. I listened to interviewees on both sides of the fence share their stories. Some Americans are earnestly seeking employment, yet remain unemployed. Others admit that 6+ months of unemployment checks are simply an incentive for them to sit at home until the free money stops coming.

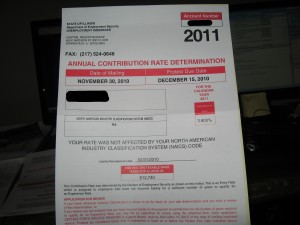

Today my company received a letter from the State of Illinois’ Department of Employment Security. Inside was our Annual Contribution Rate Determination, aka, a declaration of how much Unemployment Tax/Insurance we must pay:

This year’s rate has increased about 0.5% over last year’s, which is a direct result of continued high unemployment and Illinois’ nearly bankrupt status.

Words cannot express my frustration with this policy. The nature of the company necessitates that it conduct business as a corporation. We work only with freelancers and other small to mid-sized businesses and presently cannot afford additional employees. If the company were to dissolve, yours truly would have no route to claim unemployment. So why does Illinois demand a “Contribution Rate” of 3.8%? As Larry pointed out, unless we are aiming for socialism, a single-employee S-corporation should contribute 0%. Sure, this doesn’t help those who are unfortunately unemployed–but taking more money from a small businesses certainly doesn’t help this economy.

Right now, we need cash on hand for R&D and new product launches, which will in turn pay our freelance workers and partnering manufacturing companies, many of which are local! The more we invest, the better able we are to expand sales and generate growth. This logic didn’t set well with me until I found myself in charge of a small business. For situations like ours, higher taxes hurt.

Why do we have to pay taxes on unemployment? We need all the money we can get when we are unemployed

Yes, Ralph, corporations need to pay unemployment taxes to support the unemployed. But the above situation is a very specific case:

Say an S-corporation has a single shareholder and generates profitable earnings for 10 consecutive years, but the company suddenly fails and must be dissolved. The CEO is now unemployed, but cannot collect unemployment, as the company no longer exists. See the problem? Enabling these unemployed CEO’s to collect unemployment would create a loophole–anyone could form a meaningless corporation, then dissolve it, and then collect unemployment without ever contributing. But denying hardworking shareholders/employees access to unemployment benefits (which they paid into) isn’t exactly fair either. I propose that unemployment insurance only be collected from companies who have 2+ employees, or 1 employee earning six-figures or more.